Two Significant Pieces of News in One Week

Last week, the Government of Canada tabled the 2023 Budget. As expected, it responds to large government programs in the United States, namely the Inflation Reduction Act (IRA) and The Infrastructure Investment and Jobs Act (IIJA). The Canadian Budget builds on programs announced in the 2022 Budget and doesn’t attempt to match dollar-for-dollar with the US Government. At almost 1/10 of the population, Canada cannot compete at that level.

Share this article:Written By: Adam Johnson, Senior Vice President External Affairs at Nano One Materials Corp.

Last week, the Government of Canada tabled the 2023 Budget. As expected, it responds to large government programs in the United States, namely the Inflation Reduction Act (IRA) and The Infrastructure Investment and Jobs Act (IIJA). The Canadian Budget builds on programs announced in the 2022 Budget and doesn’t attempt to match dollar-for-dollar with the US Government. At almost 1/10 of the population, Canada cannot compete at that level.

We also saw some big news on Friday out of Washington which we’re still digesting. More on that later.

Minister Freeland acknowledged Canada’s reputation for caution and prudence, citing recent banking crises in the U.S. as evidence that this approach is advantageous in economic policies. As a result, the brakes have been hit on broader spending and investment, other than social programs, but it is full steam ahead for the clean economy.

The minister compares this once-in-a-century economic opportunity to the construction of the Transcontinental Railway, which connected the country and strengthened the economy. This analogy resonates with Nano One as we have already embarked on our Pan-Canadian endeavours to establish a sustainable economy. Our research and development innovation center is situated in British Columbia, while our commercialization facility is located in Quebec

Zoom out

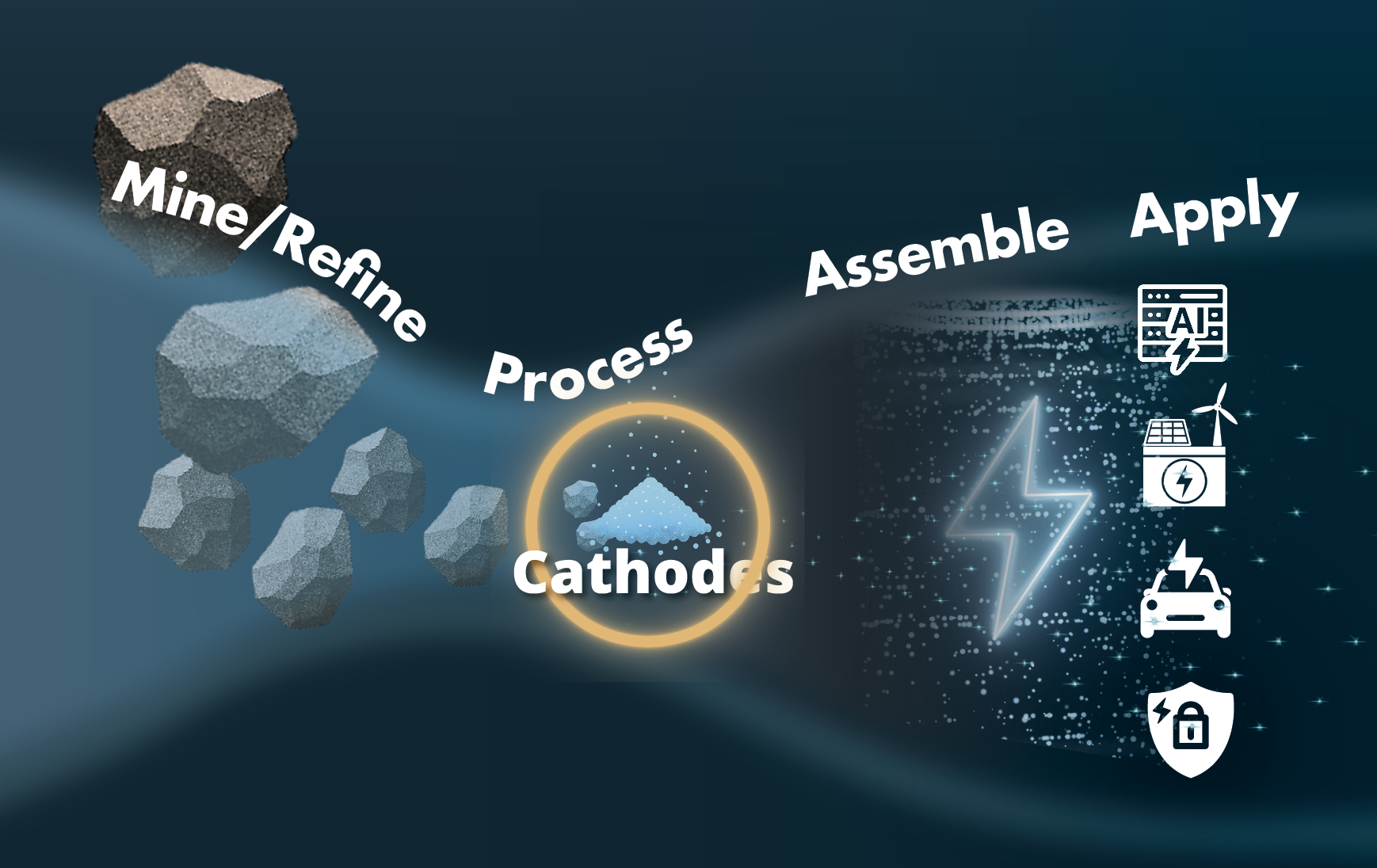

We are also paying close attention to decisions in America around how Precursor Cathode Active Materials (PCAM) and Cathode Active Materials (CAM) are treated in the IRA. We advocate for a clean, reliable, safe, and secure battery ecosystem in North America. The US Treasury Department’s Proposed Guidance is something we are monitoring, and conversations at the SAFE Summit in D.C. last week reinforced two things:

- Miners, innovative clean tech, chemical suppliers, automotive original equipment manufacturers (auto OEMs), and investors are pushing for a localized North American battery supply chain, and governments are collaborating.

- Auto OEMs have differing views on how best to deliver on electric vehicle promises. Some agree that PCAM and CAM should be allowed outside North America and qualify for IRA benefits. Other OEMs have set in motion a North American system that is more stringent when it comes to allowing materials from outside North America.

With the IRA guidance out, a consultation period mixed with domestic politics (i.e. creating jobs while making EVs affordable) has created much activity in this space. Ultimately, Canada, the EU, and US must remain conscious that competition to attract investment may lead to a detrimental “race to the bottom,” which will hurt taxpayers and businesses in the long term. Decisions being made in 2023 will set the stage for decades to come.

Therefore, Canada’s support should be targeted, significant, and short-term to help accelerate the development of supply chains and technology toward a more favourable outcome. Canada has shown an ongoing commitment to building a battery ecosystem through tax incentives designed to encourage investment and ongoing dialogue with the US.

Regardless, there is a significant need for what Nano One is doing, and we continue to be strategic to meet demand. We can compete within the current framework of the IRA and will continue to encourage a better way of making battery materials.

Zoom In

One of the three pillars of Canada’s 2023 budget is Affordable Energy, Good Jobs, and a Growing Clean Economy. Here’s how that breaks down for companies in the EV battery supply chain:

Image source: A Made-in-Canada Plan: Strong Middle Class, Affordable Economy, Healthy Future, pg. 86

The Investment Tax Credit for Clean Technology Manufacturing

A refundable tax credit equal to 30 percent of the cost of investments in new machinery and equipment used to manufacture or process key clean technologies and extract, process, or recycle key critical minerals.

The Strategic Innovation Fund

$500 million over ten years to support the development and application of clean tech and an additional $1.5 billion of its existing resources towards projects in sectors including clean technologies, critical minerals, and industrial transformation.

Enhancing the Reduced Tax Rates for Zero-Emission Technology Manufacturers

Extend the availability of reduced rates of 4.5 percent for small businesses and 7.5 percent for other businesses by another three years, such that the reduced tax rates would no longer be in effect for taxation years starting after 2034, subject to a phase-out starting in 2032.

Canada Growth Fund

Partnering with PSP Investments to begin making investments to support the growth of Canada’s clean economy.

Disclaimer:

This update is provided for informational purposes only and is based on the opinions and interpretations of the management of Nano One Materials Corp. (“Nano One” or the “Company”) as of the date these insights are provided. None of the information or analyses presented are intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this does not constitute investment advice or counsel or solicitation for investment in any security. The Company shall not be held responsible for any direct or consequential loss or damage arising from the use of the information provided herein. This includes, but is not limited to, any interpretation, reliance upon, or other use of such information, as well as any inaccuracies, omissions, or typographical errors. The Company does not undertake any obligation to update any that is incorporated by reference herein, except as required by applicable securities laws. Any actions taken as a result of the information provided are solely at your own risk.

Please note that any links provided to third party websites on this platform are for informational purposes only. We do not endorse or take responsibility for the content, accuracy, or any other aspect of these websites. Additionally, we are not liable for any damages or loss arising from the use or access of any third party website linked to from our platform. Users should exercise their own discretion and review the terms of use and privacy policies of any third party website before accessing or interacting with their content.