Vancouver, Canada (TSX: NANO) (OTC: NNOMF) (Frankfurt: LBMB)

Highlights – Feasibility study to support hybrid business model for technology deployment

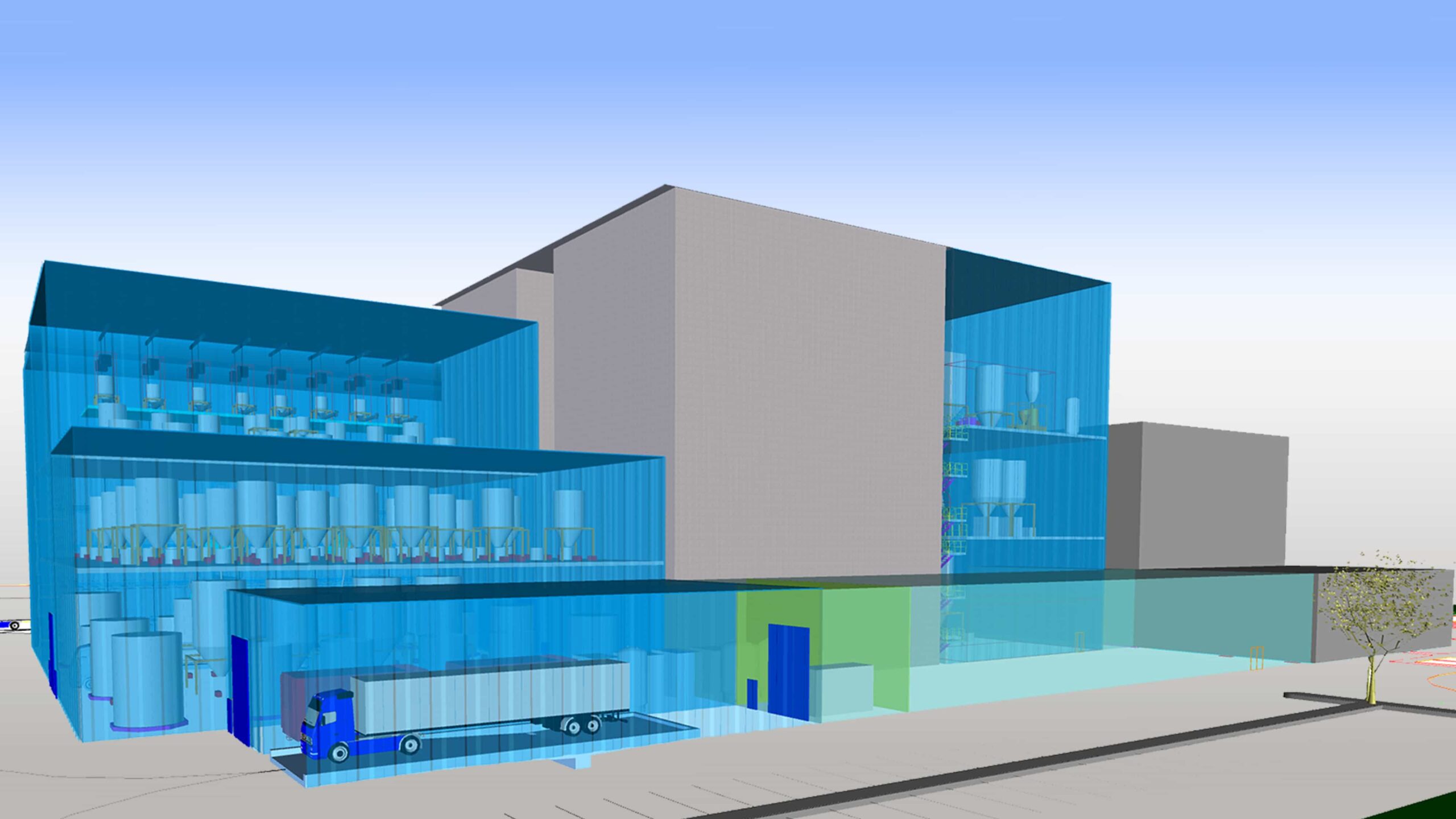

- Feasibility study (FEL 3) initiated for a 25,000 tpa LFP (Lithium Iron Phosphate) plant to support securing customer offtake, feedstock supply and future project funding.

- BBA selected to complete the study based on team’s extensive history with the Candiac plant and proven expertise in supporting the successful 200 tpa pilot plant.

- Design-Once-Build-Many growth strategy adds shareholder value while strengthening licensing and joint venture plans.

- Nano One is considering sites in multiple jurisdictions as it looks beyond the first plant to enable expansion opportunities under its hybrid business model.

- Company to file Base Shelf Prospectus as a prudent step in the normal course of business.

Nano One® Materials Corp. (“Nano One” or the “Company”) is a clean technology company with patented processes for the production of lithium-ion battery cathode materials that enable secure and resilient supply chains by driving down cost, complexity, energy intensity, and environmental footprint. Nano One is pleased to update its valued shareholders, potential financial partners and customers on the Company’s feasibility study, as it moves towards its first commercial LFP production facility.

“Nano One is pleased to announce it has commenced a feasibility study for its first commercial plant”, commented Alex Holmes, Chief Operating Officer.“ This plant design will also form the basis for our turn-key Design-Once-Build-Many strategy to address the broader LFP market. The study will provide us with an optimal production line layout and maximum utility of key equipment. Furthermore, this study will examine an ready to duplicate design, to address our mid-to-longer-term objective of deploying multi-line facilities under license or joint venture (JV) with partners in Asian, Indo-Pacific, North American and European jurisdictions.”

Progress at Nano One’s Candiac pilot plant, as reported on December 19, 2023 and February 5, 2024, has helped the company de-risk, improve and optimize its One-Pot process for LFP in commercial scale equipment while informing its engineering plans and providing confidence to its collaborators on the long-term competitive viability of its One-Pot LFP technology.

Update on First Commercial Plant

Through a competitive bidding process, Nano One chose BBA to conduct an FEL 3 which will optimize plant layout, further refine capital and operating costs and project timelines for the construction of a 25,000 tonne per annum (tpa) LFP production facility.

Denis Geoffroy, Chief Commercialization Officer, stated, “Our confidence in working with the BBA team is built on a strong foundation based on the involvement of key members of the team in the engineering, design and construction of the Candiac plant over a decade ago when I was the General Manager. More recently, BBA was also involved in the design and engineering of our 200 tpa LFP pilot line which was successfully built and commissioned in Q3 2023. BBA brings a deep expertise in mining, metals, energy, chemicals, power and renewables. We are pleased to building on their experience while adding nearly twenty years of our own, in technology scaling, commercialization and production.”

As an integral part of its feasibility study, the Company has been in active dialogue with governments and their agencies on key factors that impact its ability to scale-up rapidly and meet market demands. To that end, Nano One has determined that it is in its best interests to consider a broader set of site options that may be more suitable for future growth expansion beyond the first 25,000 tpa capacity plant. Key considerations include government incentives in the form of grants and forgivable loans, access to sufficient utilities (power, water, natural gas) and location preferences from collaborating stakeholders in the first commercial plant. Nano One with the support of provincial and municipal governments has identified potential site options in Québec and Ontario. The Company remains in active discussions with governments at all levels, as well as other strategic partners in 2024 to narrow down its site selection. Nano One is also closely monitoring government incentive programs in America and with its free trade partners, and has been engaged in conversations with several state and local governments to ensure that we can align our business plans and scale-up to meet emerging market needs in America.

With an emerging market for LFP projected to be tens of billions of dollars by 20351, the company is addressing this opportunity by aligning its first facility and partnerships to showcase the advantages of the One-Pot process and the speed-to-market benefits of its Design-Once-Build-Many growth strategy.

2024 Path to Commercialization

The company remains well capitalized and is looking to maximize opportunities to secure support from governments. The first commercial plant will require completion of the FEL 3, product validation and customer offtake and feedstock supply agreements. These three items are fundamental for project financing and are a top priority for Nano One in 2024.

The Company is in active dialogue with government agencies, project finance lenders and strategic partners to secure funding for both its growth activities, first commercial LFP plant and ongoing innovations. A final investment decision will only be made following the securing of plant specific funding. Nano One is evaluating creative structures together with government incentives to bring One-Pot LFP to market sooner while being cognizant of shareholder’s interests.

In support of its strategic objectives, Nano One will be filing a preliminary base shelf prospectus (“Shelf Prospectus”) that will help provide the most flexible and efficient access to capital markets, if and when it is needed. While the Company has no immediate plans to issue securities at this time, the Shelf Prospectus, when made final or effective, would permit the Company to make offerings of various financial securities, up to an aggregate total of C$175 million at its discretion for an effective period of 25-months. The Company considers this as a prudent step in the normal course of business.

During the 25-month period that the Shelf Prospectus would remain effective, the nature, size and timing of any financings would be dependent on the Company’s assessment of its requirements for funding and general market conditions. At the time any securities covered by the Shelf Prospectus are offered for sale, a prospectus supplement containing specific information regarding the terms of the securities being offered would be provided. A copy of the Base Shelf Prospectus will available on the Company’s issuer profile on SEDAR+ at www.sedarplus.ca.

This news release does not constitute an offer to sell or the solicitation of an offer to buy any Securities in any jurisdiction. This news release is not an offer for sale within the United States of any Securities or other securities of Nano One.

Candiac Facility Update

Nano One has confirmed orders from its Candiac facility for approximately 1.3 tonnes of LFP samples for the purposes of commercial evaluation and collaboration. Sample evaluation by potential offtakers has been positive with a collaborative approach to optimizing Nano One’s commercial LFP offerings. Building on initial samples sold in Q4 2023, there is significant interest in validating Nano One’s LFP product at scale for future offtake. The decisions to offtake LFP are being driven by advancements at Nano One’s innovation hub in Burnaby, commercialization hub in Candiac, and electric vehicle adoption policies such as the Inflation Reduction Act (IRA) as well as the equally important energy storage solutions (ESS), for industrial and military sectors.

Further and full automation of the Candiac pilot plant could help it reach up to 2000 tpa capacity and is contingent on initial sales commitments, customer technology validation needs, capital support from government and financial returns. The Company remains positive about potential opportunities in this growing market and believes that a portfolio of customers, both large and small, will help provide the right-sized offtakes to leverage the capacity of its pilot plant, to fill the capacity of a much larger first commercial plant and to secure the necessary project finance.

Dan Blondal, Chief Executive Officer and Founder stated, “Our Design-Once-Build-Many growth strategy capitalizes on both near-term and mid-term market opportunities and enables rapid growth via licensing and joint venture. Our One-Pot process reduces cost, complexity and GHG emissions in the supply chain, while eliminating wastewater, large volumes of challenging sulfate by-products, and the need for intermediate processing in foreign jurisdictions of concern. Through this combination of compelling enviro-economic value and turn-key deployment, we believe we can prudently address LFP’s rapid growth opportunity, capture market share and deliver value to shareholders, partners and government stakeholders.”

###

About BBA

BBA has been providing a wide range of consulting engineering services for over 40 years. Today, its engineering, environmental and commissioning experts team up to quickly and accurately pinpoint the needs of industrial and institutional clients. The firm’s expertise is recognized in the Energy and Natural Resources industry. With 20 offices in Canada and internationally (USA and Chile), offering clients local support and field presence, BBA provides some of the industry’s most innovative, sustainable and reliable engineering solutions.About Nano One®

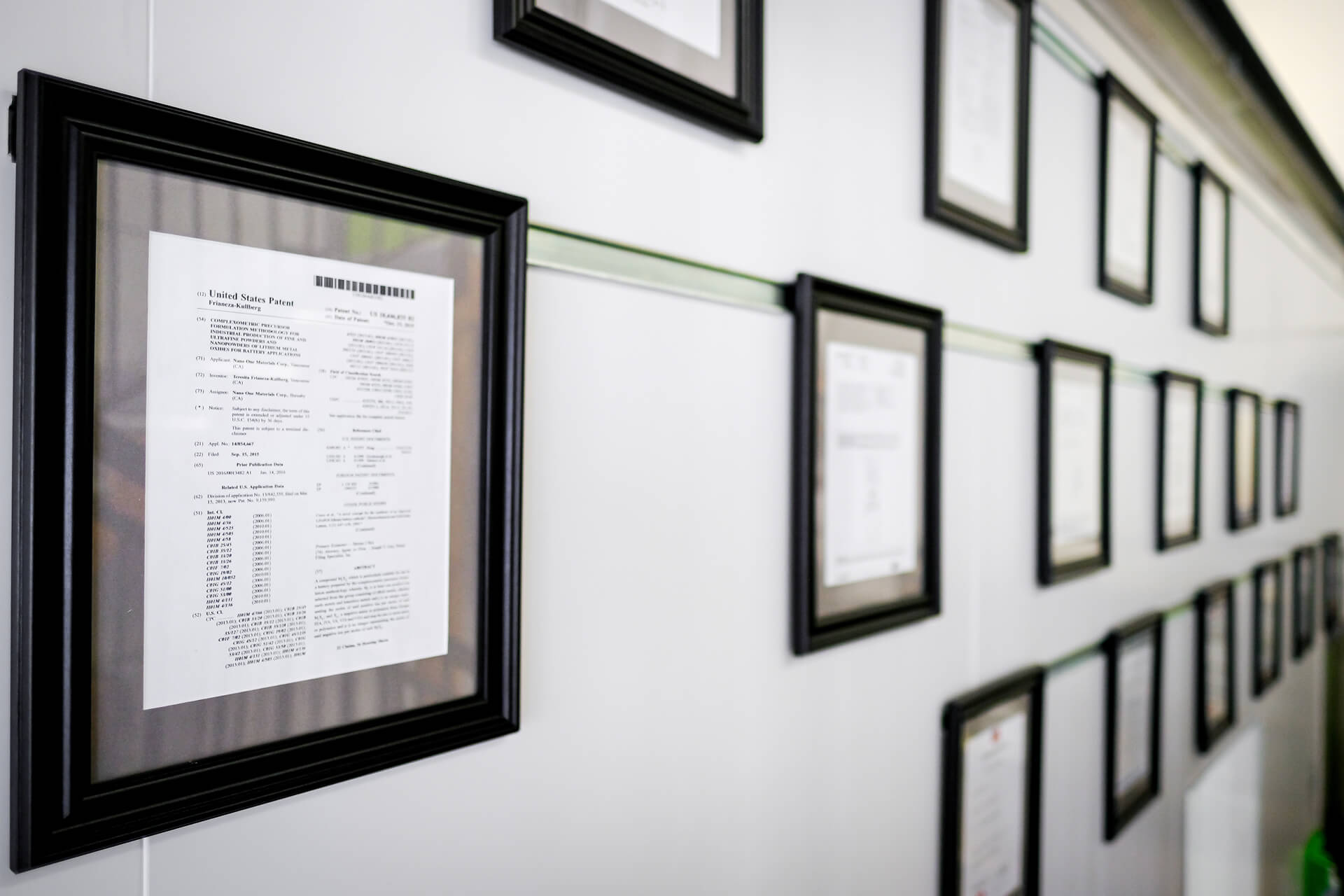

Nano One Materials Corp. (Nano One) is a clean technology company with a patented, scalable and low carbon intensity industrial process for the low-cost production of high-performance lithium-ion battery cathode materials. With strategic collaborations and partnerships, including automotive OEMs and strategic industry supply chain companies like Sumitomo Metal Mining, BASF, Umicore and Rio Tinto. Nano One’s technology is applicable to electric vehicles, energy storage, and consumer electronics, reducing costs and carbon intensity while improving environmental impact. The Company aims to pilot and demonstrate its technology as turn-key production solutions for license, joint venture, and independent production opportunities, leveraging Canadian talent and critical minerals for emerging markets in North America, Europe, and the Indo-Pacific region. Nano One has received funding from SDTC and the Governments of Canada and British Columbia.

For more information, please visit www.nanoone.ca

Company Contact:

Paul Guedes

info@nanoone.ca

(604) 420-2041

Cautionary Notes and Forward-looking Statements

Certain information contained herein may constitute “forward-looking information” and “forward-looking statements” within the meaning of applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements. Forward-looking information in this news release includes but is not limited to: the Company’s future business and strategies; industry demand; anticipated joint development programs; incurrence of costs; competitive conditions; general economic conditions; the intention to grow the business, operations, revenues and potential activities of the Company; the functions and intended benefits of Nano One’s technology and products; the development of the Company’s technology, supply chains and products; current and future collaboration engineering, and optimization research projects; plans for construction, scale-up and operation of a multi cathode piloting hub; the commencement of a commercialization phase; prospective partnerships and the anticipated benefits of the Company’s partnerships; the purpose for expanding its facilities; scalability of developed technology; and the execution of the Company’s plans – which are contingent on support and grants. Generally, forward-looking information can be identified by the use of terminology such as ‘believe’, ‘expect’, ‘anticipate’, ‘plan’, ‘intend’, ‘continue’, ‘estimate’, ‘may’, ‘will’, ‘should’, ‘ongoing’, ‘target’, ‘goal’, ‘potential’ or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the current opinions and estimates of management as of the date such statements are made are not, and cannot be, a guarantee of future results or events. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements or forward-looking information, including but not limited to: general and global economic and regulatory changes; next steps and timely execution of the Company’s business plans; the development of technology, supply chains, and plans for construction, scale-up, and operation of cathode production facilities; achievement of industrial scale piloting, demo commercial production and potential revenues; successful current or future collaborations that may happen with OEM’s, miners or others; the execution of the Company’s plans which are contingent on support and grants; the Company’s ability to achieve its stated goals; the commercialization of the Company’s technology and patents via license, joint venture and independent production; anticipated global demand and projected growth for LFP batteries; and other risk factors as identified in Nano One’s MD&A and its Annual Information Form dated March 29, 2023, both for the year ended December 31, 2022, and in recent securities filings for the Company which are available at www.sedar.com. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. The Company does not undertake any obligation to update any forward-looking statements or forward-looking information that is incorporated by reference herein, except as required by applicable securities laws. Investors should not place undue reliance on forward-looking statements.

[1] Demand data from Benchmark Mineral Intelligence Q2 2023 Lithium Ion Battery Database, pricing assumes the prior 6 months’ average from Benchmark’s 2023 Monthly Cathode Assessments.